/ Globe PR Wire /

Acquisition Atlas, a data intelligence startup founded by serial entrepreneur Joshua Guttilla, has announced the launch of its flagship platform designed to help real estate investors and brokers identify distressed property opportunities through AI-driven lien analysis.

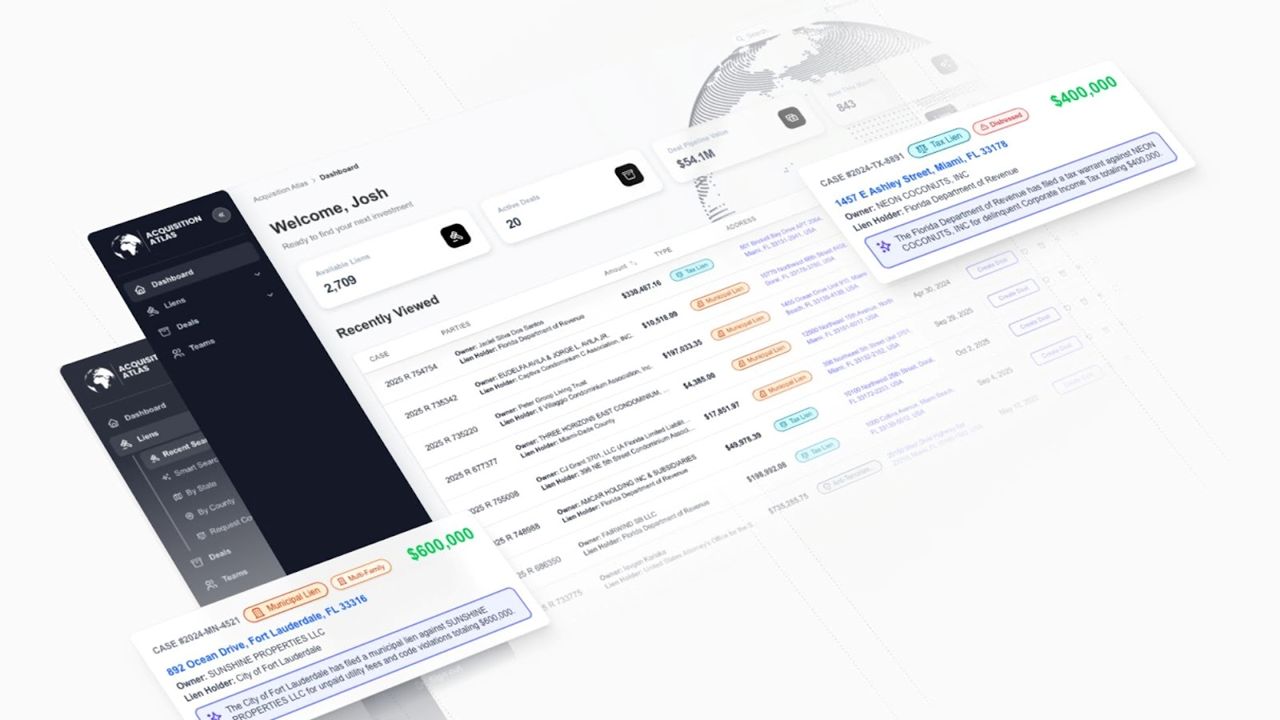

The platform, currently live in Miami-Dade County, leverages artificial intelligence to automatically scan, read, and interpret lien filings — converting complex legal documents into structured, searchable deal intelligence. By integrating property valuations, foreclosure status, ownership data, tax records, and contact information, Acquisition Atlas enables investors to spot high-potential opportunities far earlier than traditional public record methods allow.

“In commercial real estate, the earliest insight wins the deal,” said Joshua Guttilla, Founder and CEO of Acquisition Atlas. “Investors and brokers were spending 20 to 30 hours a week manually digging through county lien filings just to find signals of distress. We built an Acquisition Atlas to eliminate that bottleneck — turning a week’s worth of research into instant, actionable data.”

Bringing Transparency to a Hidden Layer of the Market

Historically, county lien filings have been a goldmine for uncovering off-market deals and early signs of financial distress. However, the data has been notoriously fragmented, difficult to interpret, and often locked in scanned PDFs buried within county clerk portals. Acquisition Atlas uses a proprietary AI engine that reads, classifies, and structures this unstandardized data in real time, surfacing properties tied to tax, code, municipal, and judgment liens.

For professionals in commercial real estate (CRE), private equity, and distressed asset acquisition, the platform delivers a competitive advantage — revealing motivated sellers and distressed assets before they ever hit the open market.

Industry Adoption and Early Success

Early users, including several Miami-based CRE firms and investment groups, have already begun integrating Atlas into their acquisition workflows. Many professionals previously relied on manual lien-based research to uncover off-market deals — a process that was time-intensive and error-prone. Acquisition Atlas automates that workflow entirely, bringing new levels of efficiency, accuracy, and scalability to the deal discovery process.

Guttilla, who previously founded Odin Consulting Group, an AI automation consultancy, and BASEco, a 3D sales and ownership platform for home sellers and real estate professionals, says his background in both AI development and real estate gave rise to the idea.

“AI has reached a point where it can handle legal document parsing, valuation modeling, and property data enrichment with near-human precision,” he added. “The opportunity was obvious; bring automation and clarity to one of the most opaque corners of real estate data.”

A Nationwide Rollout Ahead

While Miami-Dade serves as the launch market, Acquisition Atlas plans to expand coverage to major metros, including Los Angeles, New York, Dallas, and Chicago in 2026. The company is also developing premium tiers for institutional users, providing portfolio tracking, team collaboration, and advanced analytics features.

About Acquisition Atlas

Acquisition Atlas is a real estate intelligence platform that uses artificial intelligence to transform public lien filings into structured, actionable insights. By automating the discovery of distressed properties, Atlas empowers investors, brokers, and developers with a faster, simpler path to uncovering off-market opportunities. To explore the platform, visit www.acqatlas.com

Contact Details

Company Name: Acquisition Atlas

Website: acqatlas.com

Email: contact@acqatlas.com

Country: United States

City: Miami, Florida

Phone no: 602-359-8306

Contact person: Joshua Guttilla